Main Content

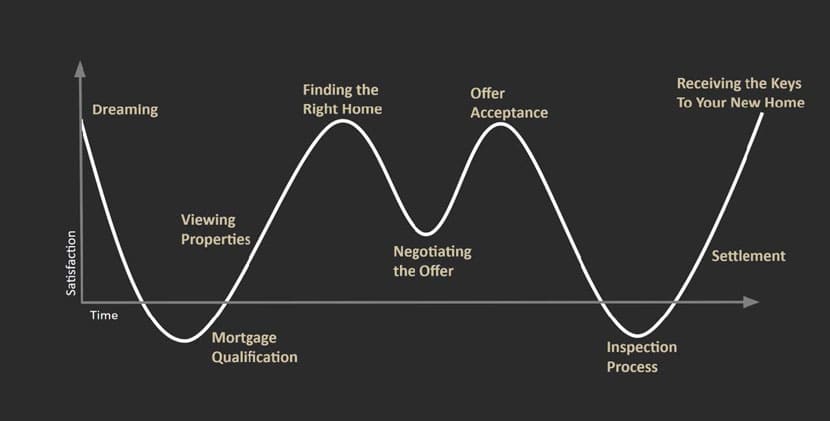

Highs and Lows ofThe Home Buying Process

Reasons toBuy a Home

Our living situation directly impacts how we feel about our quality of life, which is why many people dream of the day they have a home to call their own.

Buying a home is one of the best ways to protect and grow your wealth. Real estate will typically ride out a market’s ups and downs and appreciate with time. You will also build equity as you pay down your mortgage.

Rental prices over the past ten years in the United States have increased by more than 42 percent. In contrast, your fixed-rate mortgage payments won’t rise at all.

Home owners receive tax deductions for mortgage interest and property taxes, which are both deductible on an individual’s federal income tax return.

The freedom to do whatever you wish with your home is a big incentive for many homeowners, while others can’t wait to get out from under landlord restrictions.

Hire a RealtorThe Benefits of Buyer Representation

Every home purchase is a unique and complex process, which is why 89 percent of buyer’s last year trusted a buyer’s agent to guide them, according to the National Association of Realtors 2023 Profile of Homebuyers and Sellers. Here are the advantages of having professional buyer representation in you next home purchase:

-

Market Expertise

I am on the pulse of local market dynamics, from pricing trends to neighborhoods in Fairfax and Prince William counties to help you find your next home.

-

Personalized Strategy

I dive deep to truly understand your real estate goals and develop a specialized approach to meet your needs and timeline.

-

Negotiating Skills

Recognized by the National Association of Realtors as a Real Estate Negotiation Expert, I will prepare and present competitive offers that secure the best terms and sales price for you.

-

Risk Reduction

I will help you avoid costly mistakes by navigating the maze of contracts, disclosures, reports, and contingencies.

-

Streamlined Experience

Behind the scenes, there is a whirlwind of activity, including extensive research, coordination, and paperwork.

-

Industry Connections

My network of professionals, from lenders to inspectors, works as a team to optimize every step of your home buying journey.

-

Guidance

I will do my best to give you the information you need to make clear-headed decisions. I will also do my best to keep your outlook positive during the roller coaster of emotions that are involved in buying a home.

-

Dedicated Advocacy

I am committed to protecting your interests and prioritizing your success throughout your entire buying experience.

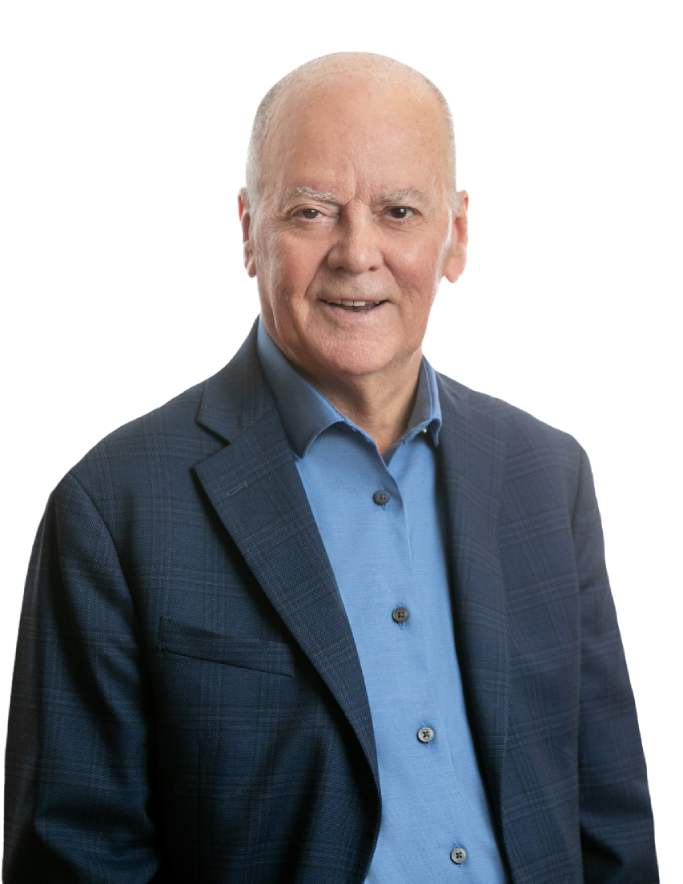

Meet Dwight

For 18 years my mission has been to help people realize their dreams through the purchase and sale of real estate and to assist them as their goals change through the various stages in their lives. Whether the immediate goal is the purchase of a first home, a larger home to accommodate changing household size, the sale of a home filled with memories prior to retirement, or the building of wealth through real estate investment, I strive to make each client feel as though they are a member of a larger real estate “family.”

On a scale of 1 to 10, I want every client’s experience working with me to be a 20. Because my business is built on referrals, my goal is to serve clients in such a way that they will be delighted enough to refer their friends and family for years to come.

My Expertise

- The National Association of Realtors recognizes me as an Accredited Buyers Representative (ABR), a Seller Representative Specialist (SRS), a Certified International Property Specialist. a Seniors Real Estate Specialist (SRES), a Military Relocation Professional (MRP), a Real Estate Negotiating Expert (RENE), a Short Sales and Foreclosure Resource (SFR) and a GREEN Realtor, whose expertise allows me to help environmentally conscious buyers and sellers analyze the eco-friendly nature of homes they wish to buy or sell.

- The Residential Real Estate Council has awarded me its Luxury Home Certification (LHC), its Residential Divorce Specialist Certification (DSC), and its Residential Listing Certification. I am a member of the Institute for Luxury Home Marketing.

Finally, I have significant relationships with some great contractors in Northern Virginia to get you the plumber, painter, or other professional you need — not just during the transaction, but after as well. Not only am I an expert in our local market, I’m also part of several nationwide networks of top agents in the luxury, seniors, investor, and green real estate spheres — putting you and your referrals in safe hands.

Differences inApproval Types

In the last year, 80% of buyers financed their home purchase. First-time buyers who financed their home typically financed 91% of the purchase, and repeat buyers financed 81%. If you will need a loan to purchase your next property, the most important step you can take is to get pre-approved.

Getting pre-approved gives you clarity on how much you can afford, which makes it a critical step to complete before you start your home search. The pre-approval letter serves as concrete proof that the lender is confident that you can afford the home on which you are making an offer and gives the seller confidence that you will complete the deal should your offer be accepted. Knowing the magic number will ensure that you don’t accidentally fall in love with a home outside your budget. You don’t want to lose out on the home of your dreams just because someone else had all their ducks in a row and you didn’t.

What isBuying Power?

Your buying power is the total amount of money you have available each month for a mortgage payment. This means the money you have each month after fixed bills and expenses, as well as any money you’ve saved for a down payment, the proceeds from the sale of your current home (if applicable), and the amount of money you’re qualified to borrow.

Why does itMatter?

Once you have clarity on your buying power, you’ll be able to buy the home you want; instead of settling for a house because you feel it’s the only one you can afford. It will also prevent you from becoming “house poor,” a common term for someone who’s put all their money toward the down payment, leaving them with little or nothing left over for fees outside of their monthly house payment.

Both scenarios can negatively impact your lifestyle. Understanding your buying power can help you get the home you want without sacrificing the lifestyle you desire.

TrustedLenders

Not all lenders are the same, and the type of loans available, interest rates, and fees can vary. Here are two of the lenders I highly recommend. In my experience, you will be better served by choosing a local lender who knows the market and is able to react quickly to changing conditions.

Leslie WishNMLS ID# 659535 | www.nmlsconsumeraccess.org

Leslie is a Senior Mortgage Loan Officer at Fairway Independent Mortgage Corp. Leslie is licensed in Virginia, Maryland, and DC and has been helping clients obtain residential mortgages for the last 36 years. Leslie’s dedication to excellence in supporting clients through the home-buying process has consistently earned her national recognition within the “Top 1%” of her industry and in the Scotsman Guide “ Top Women Originators” rankings.

Leslie can be reached at 703.338.0125 or leslie(dotted)wish(at)fairwaymc(dotted)com

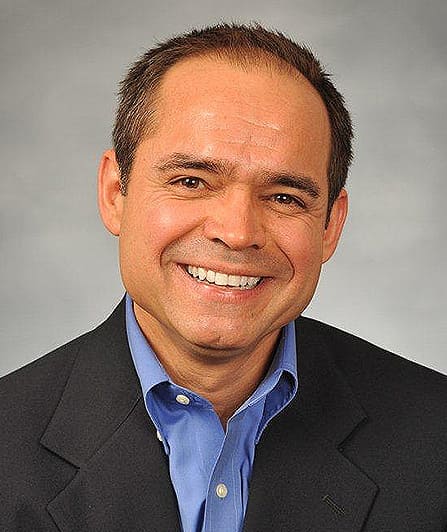

Greg FritzNMLS ID# 476390 | www.nmlsconsumeraccess.org

Greg is dedicated to providing the ideal home mortgage products and service to homeowners in Virginia, the District of Columbia, Maryland, and across the United States. Personal integrity has always been at the heart of his work ethic. As Vice President at Ameris Bank, he keep this in mind while building his team of professionals who assist him in serving you during the loan process. After your home purchase, he will continue as your point- of-contact to help with any future questions.

Greg can be reached at 703.624.5959 or greg(dotted)fritz(at)amerisbank(dotted)com

Create aWhy, Where, and What List

Finding the RightProperty

Do you need more space, access to your preferred schools, a home that requires less maintenance, or are you tired of throwing money away on rent when you could be building equity? Pinpointing the reasons why you want to move can help you assess your priorities for your home search.

Do you prefer a rural, urban, or suburban setting? How long of a commute are you willing to make? Which areas feed into your preferred schools? These decisions will impact your day-to-day life while you live in the home.

Start with the basics, including your ideal number of bedrooms, bathrooms, and square footage. Do you prefer a one-story or two- story layout? Then move on to your “wants.” Do you want the main bedroom to be on the main floor? Do you want a swimming pool, a fenced backyard, or a three-car garage? Keep in mind, you may not find a home with all of your "wants," or even all of your "needs.” If you’re faced with a tough choice about how or what to compromise on in your home search, return to your WHY.

Stay on the pulse of the housing inventory in your selected area with notifications whenever homes hit the market, change price, or go under contract with my daily market updates.

HouseWants & Needs

Determine the Features

YOU ARE LOOKING FOR IN YOUR IDEAL HOME AND PRIORITIZE WHICH ITEMS ARE MOST IMPORTANT TO YOU.

No house is perfect, but this will help us find the best match for you.

Must Have

Would Like to Have

HouseViewing Tips

- Use my “Home Search Notes” to keep track of the pluses and minuses of homes we see.

- Visit favorite neighborhoods on different days of the week and at different times of the day to get a sense of noise levels and traffic.

- Bring co-buyers, family members, or friends to be a second pair of eyes.

- If possible, speak to any neighbors who happen to be outside.

- Ask about the utility and maintenance costs.

- Make sure the house fits into your budget.

- Tell me if there’s something you hate about a house after the showing.

- Focus on the “bones” of each house rather than the decorations to see if it fits into what you want and need.

- Don't make a "spur-of-the-moment" decision.

- Be picky, but don’t be unrealistic. There is no perfect home.

Compare Your Favorite Homes

Before you make a decision, you should compare each home on your “possible” list against your wants and needs, as well as comparing their prices and cost of operation.

- What are short-term and long-term costs associated with each house you're considering?

- Are there Condo or HOA fees?

- Are there any maintenance issues which need to be addressed immediately?

- Are there any major purchases which would need to be made quickly (furniture, appliances, flooring, etc.)?

- How do the taxes vary from home to home?

- What are the commuting costs?

- Is one in a more desirable school district or closer to daycare options?

- How do the back yards measure up? Is there adequate room for your preferred activities? Is there a deck? Is the yard fenced? Are there mature trees?

- How does the finished square footage compare?

- What about neighborhood amenities, such as a pool, tennis courts or walking paths?

When we haveFound a home

That generally fits your WHY, WHERE, and WHAT, it’s time to make an offer. Yes, a high offer price gets attention, but most sellers consider a variety of factors when evaluating an offer. With that in mind, here are three other tactics you can utilize to sweeten your proposal and outshine your competition.

-

PUT DOWN A SIZEABLE DEPOSIT

Buyers can show sellers that they're serious about their offer and have "skin in the game" by putting down a large earnest money deposit. I can help you determine an appropriate deposit to offer based on your specific circumstances.

-

ASK FOR FEW (OR NO) CONTINGENCIES

Buyers in a competitive market often volunteer to waive certain contingencies, which are clauses that allow one or both parties to back out of the agreement if certain conditions are not met. I can help you assess the risks and benefits involved in this offer strategy.

-

OFFER A FLEXIBLE CLOSING DATE

People sell their homes for a wide variety of reasons, and flexible terms that work with their personal situations can sometimes make all the difference. If you have a loan that has been fully underwritten, you will be able to close in two weeks or less, which will suit many sellers. However, some sellers may require a short-term rent-back after settlement to allow them to close on a new home. I will reach out to the listing agent to find out the seller's preferred terms, and then collaborate with you to write a compelling offer that works for both parties.

The Offer Price

Factors that affect the price you offer

Marketplace

- Today’s real estate market: Is it a seller’s, buyer’s, or balanced market?

- What are today’s mortgage rates?

- What are the short and mid-term economic forecasts of where the market and interest rates are headed?

Characteristics location of the home

- Lot size greater or less than the average of the neighborhood?

- Square footage of the home greater or less than the average of the neighborhood?

- Attractive neighborhood?

- Amenities available?

- Proximity to public transportation?

- Access to major transportation routes?

Condition of the Home

- Major improvements professionally done?

- Fresh interior and exterior paint?

- Well maintained lawn and shrubs?

- Good overall curb appeal?

- Abundant light throughout the property?

Being FlexibleWill Help

moving you one step closer to finalizing

the sale of your home.

NegotiatingYour Offer

We're in a Sellers Market

For the better part of a decade, and particularly since the start of the Covid Pandemic in 2020, Northern Virginia has been in the throes of a strong seller’s market, with demand far surpassing supply. As a result, prices have soared even in the face of interest rates that have doubled over the past few years.

What that means for you as the buyer

That does not mean that buyers are powerless in today’s real estate marketplace–as long as they don’t fall in love with any given house to the point where they surrender the power they have to walk away if no reasonable deal can be struck. In their book, Getting to Yes: Negotiating Agreement Without Giving In, Roger Fisher and William Uri of the Harvard Negotiation Project call this process “developing a BATNA.” BATNA stands for Best Alternative to a Negotiated Agreement, and it’s crucial that buyers have one and stick to it. The best BATNA is an alternative home to turn to, but even a BATNA of “keep looking” is sufficient.

Getting to "Yes"

The goal is to “get to yes,” under circumstances that allow both parties to feel reasonably good about the deal. You want to buy, and the seller wants to sell. My job is to get you the home you want under conditions that leave you feeling positive about the transaction. The only way I can do that in this lopsided seller’s market is if you remain detached to the point that you can walk away if negotiations reach an impasse.

Satisfy the Contract'sContingencies

What to do after contract ratification

- Conduct Any Agreed Upon Inspections: Home; Pest; Radon

- Review HOA Documents

- Finalize Financing

- Arrange for Homeowners Insurance

Conduct a final walkthrough

Shortly before closing on your new home, you will be afforded the opportunity to conduct a final walk-through. During that process, you and I will be checking that all of the contract terms agreed to by the seller have been fulfilled, including:

- Property condition

- Conveying items

- Removal of personal items

- Property condition

- Provision of manuals, remotes, and warranties

TrustedVendors

- ALL

- Home Inspector

- House Cleaning

- Electrician

- Contractor

- Appliance Repair

- Roofing

- Plumber

- Chimney

- Septic

- Landscaping

- Carpet

- Radon

- AC & Heating

- Tree Service

Closing Day

You Made it to Closing!

On the day of closing you'll go over and sign the final paperwork, including:

- Your mortgage

- The fees associated with your purchase

- Title to the property

- Government issued photo ID

- Homeowner’s insurance certificate

- Certified funds or cashiers check

- Checkbook to cover any minor changes

SuccessStories